Сitizenship by Investment (CBI) programs offer individuals the opportunity to legally obtain a new nationality and passport in return for an investment in the economy of the host country.

The programs are particularly appealing to high-net-worth individuals seeking to enhance their global mobility, gain access to better business opportunities, secure their families’ futures, or find a safe haven.

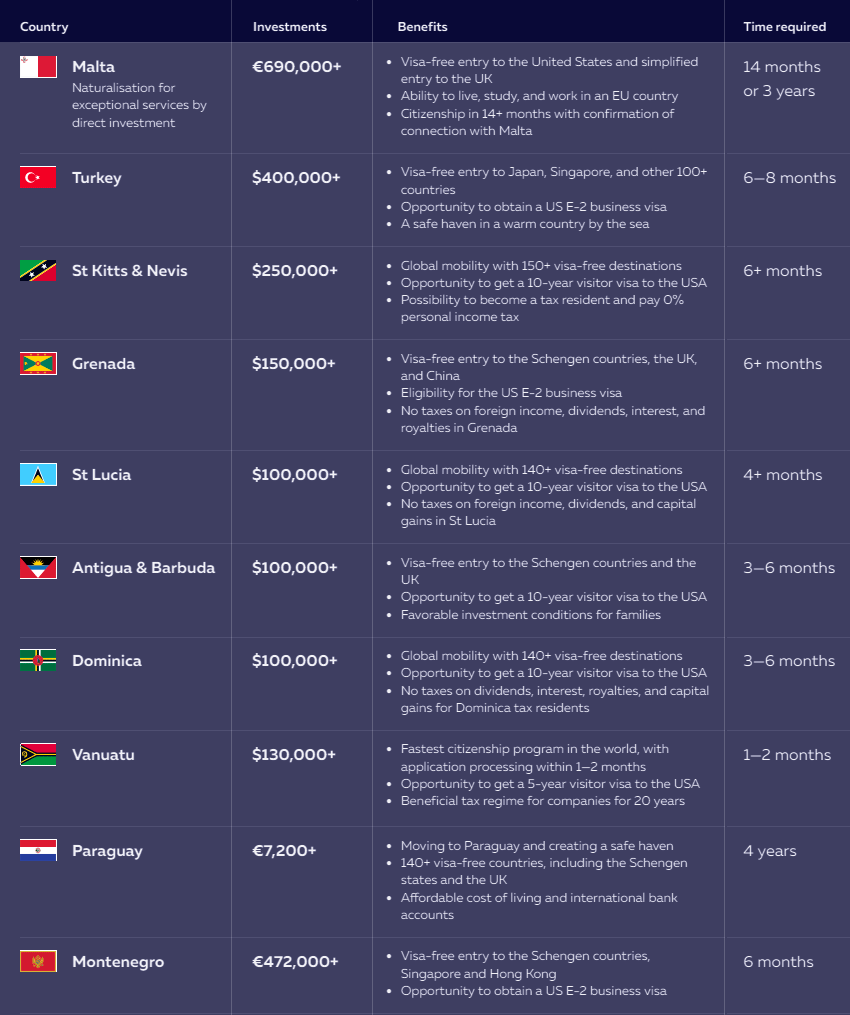

Each country’s program has its unique requirements, benefits, and investment thresholds, typically involving real estate purchases, contributions to national development funds, or investments in local business ventures.

Grant of citizenship on the basis of an investment

Most countries have provisions that allow their government to grant citizenship in return for major contributions to society, culture, the economy, and other interests of the state. However, this discretion of the government is exercised extremely rarely.

Citizenship by investment programs offer you the opportunity to legally acquire a new nationality and an alternative passport quickly and simply, without major disruption to your life.

Expanding your global access through a citizenship program is no longer a luxury reserved for the ultra-rich. Acquiring citizenship through investment is increasingly accessible as more cost-effective programs are available, and many of the cheapest citizenship by investment programs offer enticing benefits and returns for a surprisingly low investment amount.

Whether you are looking to improve your travel freedom, diversify your investment portfolio, or secure your legacy for future generations, there are a number of cheap citizenship by investment programs that can help you achieve your goals.

Several countries had programs in place at different times in the past that were specifically designed to attract foreign investors in return for citizenship. These include Ireland, whose program was terminated in 2001, Belize (until 2002), Grenada (terminated 2001 but reopened in 2014), Cape Verde, Seychelles, Slovakia, and several others.

Key Features of Citizenship by Investment Programs

- Global Mobility: A second passport from a country with a strong visa-free travel arrangement can significantly enhance an individual’s ability to travel globally. This is particularly valuable for citizens of countries with travel restrictions.

- Business Opportunities: Obtaining citizenship in a country with a favorable economic environment can provide access to lucrative business opportunities, including easier access to certain markets and the ability to operate in a more stable and secure economic climate.

- Family Security: Many programs allow investors to include family members in their applications, offering them the benefits of education, healthcare, and security that come with residency or citizenship in a developed country.

- Tax Optimization: Some individuals seek citizenship in countries with more favorable tax regimes to optimize their tax obligations, especially if the new country offers incentives for foreign investors or does not levy taxes on worldwide income.

Сitizenship by Investment Programs

You should consider several factors before pursuing citizenship through investment, including the total cost of investment, processing times, residency requirements (if any), and the legal and tax implications of acquiring a new citizenship.

It’s also crucial to ensure that the investment is made through official and legal channels to avoid scams and ensure compliance with international standards to prevent money laundering and terrorism financing.

Due diligence and consulting with legal and financial experts specializing in immigration and international tax law are essential steps in the process of obtaining citizenship through investment.

Residence & Citizenship by investment schemes

While residence and citizenship by investment (CBI/RBI) schemes allow individuals to obtain citizenship or residence rights through local investments or against a flat fee for perfectly legitimate reasons, they can also be potentially misused to hide their assets offshore by escaping reporting under the OECD/G20 Common Reporting Standard (CRS).

Identity Cards and other documentation obtained through CBI/RBI schemes can potentially be misused or abused to misrepresent an individual’s jurisdiction(s) of tax residence and to endanger the proper operation of the CRS due diligence procedures.

Potentially high-risk CBI/RBI schemes are those that give access to a low personal income tax rate on offshore financial assets and do not require an individual to spend a significant amount of time in the location offering the scheme.

Financial Institutions are required to take the outcome of the our analysis of high-risk CBI/RBI schemes into account when performing their CRS due diligence obligations.

| Jurisdiction | Name of CBI/RBI scheme |

| Antigua and Barbuda | Antigua and Barbuda Citizenship by Investment |

| Antigua and Barbuda | Permanent Residence Certificate |

| Bahamas | Bahamas Economic Permanent Residency |

| Bahrain | Bahrain Residence by Investment |

| Barbados | Special Entry and Residence Permit |

| Cyprus | Citizenship by Investment: Scheme for Naturalisation of Investors in Cyprus by Exception |

| Cyprus | Residence by Investment |

| Dominica | Citizenship by Investment |

| Grenada | Grenada Citizenship by Investment |

| Malta | Malta Individual Investor Programme |

| Malta | Malta Residence and Visa Programme |

| Saint Kitts and Nevis | Citizenship by Investment |

| Saint Lucia | Citizenship by Investment Saint Lucia |

| Seychelles | Type 1 Investor Visa |

| Turks and Caicos Islands | Permanent Residence Certificate via Undertaking and Investment in a Home |

| Turks and Caicos Islands | Permanent Residence Certificate via Investment in a Designated Public Sector Project |

| Turks and Caicos Islands | Permanent Residence Certificate via Investment in a Home or Business |

| United Arab Emirates | UAE Residence by Investment |

| Vanuatu | Development Support Programme |

| Vanuatu | Self-Funded Visa |

| Vanuatu | Land-Owner Visa |

| Vanuatu | Investor Visa |

What are CBI/RBI schemes?

“Citizenship by Investment” (CBI) and “Residence by Investment” (RBI) schemes are being offered by a substantial number of jurisdictions and allow foreign individuals to obtain citizenship or temporary or permanent residence rights on the basis of local investments or against a flat fee.

Individuals may be interested in these schemes for a number of legitimate reasons, including the wish to start a new business in the jurisdiction, greater mobility thanks to visa-free travel, better education and job opportunities for children, or the right to live in a country with political stability. At the same time, information released in the market place and obtained through the OECD’s Common Reporting Standard (CRS) public disclosure facility, highlights the abuse of CBI/RBI schemes to circumvent reporting under the CRS.

How can CBI/RBI schemes be misused to circumvent CRS reporting?

CBI/RBI schemes can be misused to undermine the CRS due diligence procedures. This may lead to inaccurate or incomplete reporting under the CRS, in particular when not all jurisdictions of tax residence are disclosed to the Financial Institution. Such a scenario could arise where an individual does not actually or not only reside in the CBI/RBI jurisdiction, but claims to be resident for tax purposes only in such jurisdiction and provides his Financial Institution with supporting documentation issued under the CBI/RBI scheme, for example a certificate of residence, ID card or passport.

Which CBI/RBI schemes present a potentially high risk?

Not all RBI/CBI schemes present a high risk of being used to circumvent the CRS. Schemes that are potentially high-risk for these purposes are those that give a taxpayer access to a low personal income tax rate of less than 10% on offshore financial assets and do not require significant physical presence of at least 90 days in the jurisdiction offering the CBI/RBI scheme. This is based on the premise that most individuals seeking to circumvent the CRS via CBI/RBI schemes will wish to avoid income tax on their offshore financial assets in the CBI/RBI jurisdiction and would not